-

1 Introduction

Climate change is one of the most pressing societal issues of our time. To turn the demolishing consequences, in the Paris Agreement of 2015, the United Nations Convention on Climate Change (UNFCCC) formulated the long-term goal to limit global warming to well below 2, preferably to 1.5°C, compared to preindustrial levels. Similar to any other national government that signed the climate agreement, the Dutch government translated these goals into policy resolutions, formulated in a National Climate Agreement,1x See for version of the Climate Agreement translated in English: www.klimaatakkoord.nl/documenten/publicaties/2019/06/28/national-climate-agreement-the-netherlands (last visited 31 October 2022). followed by a codification of the goals in a national Climate Act.2x Klimaatwet, Stb. 2019, 254, https://wetten.overheid.nl/BWBR0042394/2022-03-02 (last visited 31 October 2022). The goals are regulated in Art. 2 Climate Act of which the first clause states: ‘This law provides a framework for the development of policies aimed at irreversibly and step-by-step reduction of greenhouse gas emissions in the Netherlands, to a level that is 95% lower in 2050 than in 1990, in order to limit global warming and climate change’. Art. 2(2) states: ‘In order to achieve this target for 2050, our Ministers who are concerned aim for a reduction in greenhouse gas emissions of 49% by 2030 and a full CO2-neutral electricity production by 2050’. The National Climate Agreement also addresses specific roles and tasks to local governments to limit climate change.3x See the advice from The Council for Public Administration, ‘Van Parijs naar praktijk; bekostiging en besturing van de decentrale uitvoering van het klimaatakkoord’, www.raadopenbaarbestuur.nl/documenten/publicaties/2021/01/25/advies-van-parijs-naar-praktijk (last visited 31 October 2022). In this way, the global climate goals trickle down through national policies towards local climate action.4x The role of local governments in the achievement of SDGs is also acknowledged by the EU Commission: see https://ec.europa.eu/commission/presscorner/detail/en/IP_22_5395 (last visited 31 October 2022).

In the Dutch Climate agreement, the Netherlands is divided into 30 so-called Energy Regions. Provinces, water boards and municipalities are working together in these regions to set up a ‘Regional Energy Strategy’.5x See the website of the National Program Regional Energy Strategy: www.regionale-energiestrategie.nl/default.aspx (last visited 31 October 2022). In this strategy, the regional choices are developed for:the generation of renewable electricity;

the heat transition in the built environment; and

the required storage and changes in the energy infrastructure.

Local governments, through their umbrella organisations, have endorsed the national Climate Agreement and the climate goals included therein.6x See for the endorsements of the Association of Dutch Municipalities: https://vng.nl/rubrieken/onderwerpen/klimaatakkoord; Waterboards: https://unievanwaterschappen.nl/themas/klimaatakkoord/; and Provinces: www.ipo.nl/thema-s/klimaat-en-energie/ (all last visited 2 December 2022). In addition, many local governments have also concluded local climate agreements and formulated their own climate goals.7x See for examples the cities of Amsterdam: www.nieuwamsterdamsklimaat.nl/, Rotterdam: www.rotterdamsklimaatakkoord.nl/ and The Hague: www.haagsklimaatpact.nl/index.php/ambities-haags-klimaatpact/ (last visited 31 October 2022).

To achieve their climate objectives, local authorities not only need policy space, but also legal powers and financial instruments to fund these policies, such as taxes. In this article, we explore if and how existing taxation by local governments in the Netherlands could play a role in achieving climate goals. In 2021, it was estimated that the implementation of the tasks assigned to local governments in the National Climate Agreement will cost them around € 1.8 billion,8x See the advice from The Council for Public Administration, above n. 4. the funding of which is currently being discussed.In this article, we will investigate the following questions:

What roles can (local) taxes in general play in pursuing climate goals? (Section 2)

Which factors within the current Dutch context are limiting and which are contributing to the effectiveness of the use of local taxes in the pursuit of climate goals? (Section 3)

What insights does this analysis provide and to what extent can these also be relevant outside the Dutch context? (Section 4)

The article ends with a conclusion (Section 5).

-

2 General Roles of (Local) Taxes in Achieving Climate Goals

Since ambitious goals are set to fight climate change, there is a wide search for instruments to achieve these goals. Not only technical instruments, such as CO2 capture and storage technology, but also legal and financial instruments are investigated. Taxation might be one of the financial instruments that could help achieve climate goals.

Firstly, taxes have a funding role: they are levied to generate revenue for public spending. Governmental measures and services to achieve climate goals could be paid for by the revenue of taxes. The role of taxation in helping achieving sustainability goals (the UN SDGs) by its revenue has been broadly acknowledged and also recommended by several international organisations, including the UN, OECD, World Bank and IMF.9x A. Pirlot, Chapter 4, pages 17-18 ‘A Legal Analysis of the Mutual Interactions between the UN Sustainable Development Goals (SDGs) and Taxation’, in C. Brokelind and S. van Thiel (eds.), Tax Sustainability in an EU and International Context (2020). She mentions UN General Assembly, Resolution A/RES/70/1, ‘Transforming Our World: The 2030 Agenda for Sustainable Development’, adopted on 25 September 2015, 21 October 2015, at paragraph 17.1, p. 26. And OECD, ‘OECD and the Sustainable Development Goals: Delivering on Universal Goals and Targets’, at www.oecd.org/dac/sustainable-development-goals.htm (last visited 31 October 2022). She also refers to IMF, OECD, UN, World Bank Group, ‘Taxation & SDGs. First Global Conference of the Platform for Collaboration on Tax’, Conference Report, 14-16 February 2018. See www.oecd.org/ctp/countries-must-strengthen-tax-systems-to-meet-sustainable-development-goals.htm (last visited 31 October 2022). Climate goals are amongst these SDGs. Prerequisite for this role of taxes in funding climate measures to meet the corresponding SDGs is a sufficient potential revenue of the taxes used. In case environmental taxes are used to raise revenue for climate goals, this could be difficult. Taxing polluting behaviour or environmental harmful events might lower the revenue if people adjust their behaviour. An effective environmental tax leads to less revenue in time unless rates are increased.10x For a more elaborated view on the effectiveness of environmental taxes in achieving climate goals, see D. Fullerton, A. Leicester, & S. Smith, Chapter 5, pages 435-436 ‘Environmental Taxes’, in Dimensions of Tax Design (IFS 2010).

But there is another option regarding the use of taxation for climate goals, namely the possibility of influencing behaviour by fiscal incentives and disincentives in other taxes than environmental taxes. Desirable behaviour, such as business investment in less polluting technologies and private people’s choice for environment-friendly alternatives, could be stimulated by lowering rates or tax exemptions. Unwanted polluting behaviour could be discouraged by higher rates or by introducing a specific levy. There is not a widespread consensus about using taxes for social engineering. This role meets several ‘ifs, buts and maybes’. A major concern is the effectiveness of fiscal (dis)incentives in achieving the aspired goal. Vanistendael and Redonda conclude that a tax is not an adequate instrument to eliminate harmful environmental behaviour in an absolute way and that taxes are a very inaccurate instrument to achieve specific targets of social engineering.11x F. Vanistendael, Chapter 2, page 51 ‘Reflections on Taxation and the Choice between Development and Sustainability’, in C. Brokelind and S. van Thiel (eds.), in Tax Sustainability in an EU and International Context (2020) and A. Redonda, Chapter 9 pages 193-194 ‘Tax Expenditures and Inequality’, in C. Brokelind and S. van Thiel (eds.), Tax Sustainability in an EU and International Context (2020). A more direct way to reach the goal of elimination of harmful environmental behaviour should be a legal prohibition sanctioned by fines and prison sentences. Regarding tax incentives to stimulate investment, Van Thiel remarks that taxation is only one and not necessarily the most crucial factor that influences an investment decision. Offering tax incentives to compensate for investment climate deficiencies may not be effective and is discouraged.12x S. van Thiel, Chapter 1, page 25 ‘Sustainable Taxes for Sustainable Development’, in C. Brokelind and S. van Thiel (eds.), Tax Sustainability in an EU and International Context (2020). Van Thiel refers to OECD, Tax Incentives for Investment: A Global Perspective Experiences in MENA and Non-MENA Countries (2008). Secondly, tax incentives might provide an advantage to an investment that would have also taken place without the incentive.13x See for a more elaborated guideline for an effective approach of tax incentives for sustainable investments, including preventing the ‘gift effect’, IMF, World Bank, OECD and UN, Options for Low Income Countries’ Effective and Efficient Use of Tax Incentives for Investment, report to the G-20 Development Working Group, 2015.

Two other concerns, besides the question about the effectiveness, are the potential conflict with state aid regulation within the European Union (EU)14x See J. Pedroso and J. Kyrönviita, Chapter 16, page 377 ‘A Pluralistic Approach to the Question How to Balance Different Objectives of Sustainable Development through Environmental Taxes within the Framework of EU State Aid Law’, in C. Brokelind and S. van Thiel (eds.), Tax Sustainability in an EU and International Context (2020). See also P. Pistone and M. Villar Ezcurra (eds.), Energy Taxation, Environmental Protection and State Aids (2016). and the issue of potential climate poverty.15x See M. Lewandowski, Chapter 15, pages 347-349‘Energy Poverty and Energy Taxation in the European Union: An Overview of Tax Measures’, in C. Brokelind and S. van Thiel (eds.), Tax Sustainability in an EU and International Context (2020). Firstly, government spending on climate goals and fiscal incentives for climate-friendly investments might conflict the state aid prohibition within the EU. Especially the selectivity criterion can be easily fulfilled when drafting a special sustainability incentive in an environmental tax. Secondly, fiscal incentives could lead to the missing out of specific groups of taxpayers with low income. If people are not able to take climate-friendly measures or to choose the more environmentally friendly option because of their poor financial position, they also miss the financial advantage of the fiscal incentives, like lower rates and tax exemptions. And if the government simultaneously increases rates for the more polluting options, the tax burden shifts to taxpayers who are not able to adjust their behaviour. Moreover, climate goals cannot be achieved effectively if not everyone can join in because of their financial position.

Given these concerns, tax influencing can only play a modest role in helping achieve climate goals. Vanistendael noted that taxes can help accelerate changes in behaviour, specifically when there are clear alternatives of desirable behaviour that can be facilitated by financial support.16x Vanistendael, above n. 12 pages 52-53 2. Redonda states that estimating and reporting the fiscal cost of tax exemptions should be a priority for governments worldwide. This would not only enhance transparency and accountability, but also help to evaluate the effectiveness and efficiency of these provisions, which should help governments to better target their policy objectives.17x Redonda, above n. 12, page 210.

Local taxes are amongst the financial instruments that governments could use to help achieve climate goals and perform the tasks. For local taxes, all the above-mentioned concerns are applicable. Influencing behaviour through the adjustment of tax rates and the introduction of tax exemptions meets several concerns. The major concern, namely the effectiveness of tax measures, is even more important for local taxation. In the Netherlands, rates and therefore the potential revenue of local taxes are relatively low, related to tax rates and revenue of national taxes which could also hinder the effectiveness of tax measures for climate policies. The effectiveness of tax measures at the level of the local government can also be negatively affected if different neighbouring local governments implement different tax incentives and disincentives. People might avoid higher rates by moving polluting behaviour to the neighbouring municipality. Lastly, differences in local climate provisions and in local tax systems might also raise questions about the equality of citizens and companies. -

3 Limiting and Contributing Factors to the Effective Use of Local Taxes for Climate Goals

As described in Section 2, the primary function of tax instruments is funding public spending. In addition, taxes can be used to achieve certain policy goals by using them as a price incentive. The price incentive is then intended to influence the behaviour of taxpayers. Based on both functions, respectively in Sections 3.3 and 3.4 we discuss the current restrictions and possibilities specifically for municipal taxes in achieving climate objectives in the Netherlands. We will do the same for taxes of provinces and water boards in Section 3.5.

For a good understanding of our analysis, in Section 3.1 we will first describe briefly the decentralisation and financial position of local governments in the Netherlands. In Section 3.2 we will explain the legal limitations and possibilities of local taxation in the Netherlands in general.3.1 Decentralisation and Financial Position of Local Governments in the Netherlands

The Kingdom of the Netherlands is a constitutional monarchy. The European part of the Netherlands consists of 12 provinces and 345 municipalities. The Dutch Constitution enshrines the fact that the Netherlands is a decentralised unitary state. On the one hand, provinces and municipalities have a general power of regulation and administration, which can only be limited by or pursuant to the law. On the other hand, provinces and municipalities are obliged to cooperate in the implementation of rules laid down by central government and may be subject to supervision by or pursuant to the law.

The idea of decentralisation entails that some of the responsibilities of the central government are left to other public bodies and their agencies, which are more or less independent from the central government. Territorial decentralisation requires that provinces and municipalities have general legislative and administrative powers within their territory. Functional decentralisation means that one or more branches of central government functions are left to other public bodies. In the Netherlands, this is the case with water boards.18x Dutch water boards are regional governmental bodies charged with managing water barriers, waterways, water levels, water quality and sewage treatment in their respective regions. The central government, the provinces, the municipalities and the water boards all have their own independent competences to levy taxes. The taxes that provinces, municipalities and water boards can levy are determined and restricted by legislation that is incorporated in coordinating acts: respectively the Provinces Act, the Municipalities Act and the Water Boards Act. These acts contain both tax and non-tax provisions.Income Sources of Dutch Municipalities

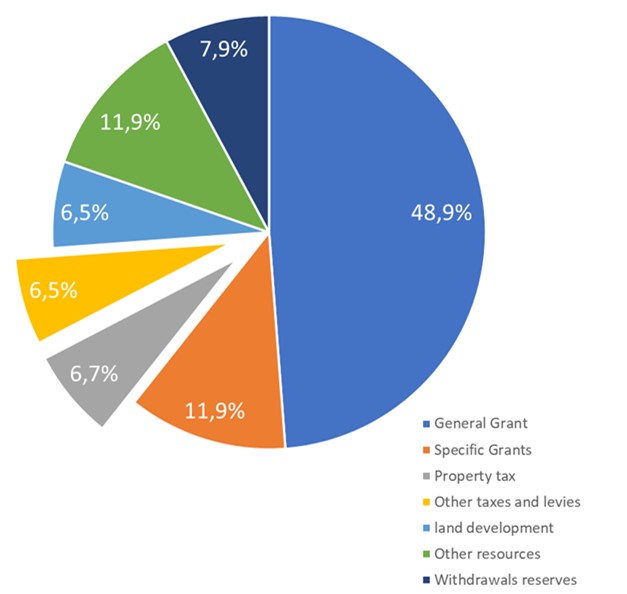

The main funding of Dutch municipalities and provinces comes from the central government.19x By governmental financial transfers through grants from the Province Fund and Municipality Fund. In the total revenue of all levels of Dutch government, the revenues of local governments represent a share of only 3.4%. This puts the Netherlands far below average compared to the other OECD countries. To illustrate, in Denmark and Sweden this percentage is 25.7% and 35.5%, respectively.20x Organization for Economic Cooperation and Development (OECD), Revenue Statistics (2021), Table 1.4. A relatively small part of the revenue consists of local governments’ own income. In budgetary terms, in 2021, municipal levies in the Netherlands amounted to € 11,312 million in total, corresponding to 1.35% of the GDP.21x CBS, ‘Gemeentebegrotingen; heffingen naar regio en grootteklasse’, www.cbs.nl/nl-nl/cijfers/detail/83614NED (last visited 31 October 2022). This is per capita € 647. In the Netherlands, municipalities receive roughly one-sixth of their income from taxes. The main source of income of municipalities is financial transfer from the central government in the form of general and specific grants (see Figure 1). Property taxes account for 40.3% of the local tax income, other taxes (e.g. ‘parking taxes’) account for 16%; 34.4% of the municipal income comes from sewage and waste processing taxes and 9.3% from fees for services.

In 2021, Dutch provinces received roughly one-fifth of their income from taxes amounting to € 1,733 million in total.22x Ministerie van Financiën, ‘Rijksbegroting’, www.rijksfinancien.nl/memorie-van-toelichting/2022/OWB/C/onderdeel/1066575 (last visited 31 October 2022). Apart from tax revenue and financial transfers from the central government, there are differences between municipalities in their financial position. For example, the city of Rotterdam sold its shares in the former municipal energy company Eneco and gained a substantial revenue by doing so, whilst other municipalities did not have such income. Rotterdam now has the opportunity to use this revenue for funding local climate initiatives, whilst other cities must raise their taxes.

The main source of income of provinces is financial transfer from the central government in the form of general and specific grants (in 2021: € 2,543 million). The main tax of the provinces is surcharge on the state motor vehicle tax (in 2021: € 1,701 million). Dutch water boards do not receive any financial transfer from the central government. Their main source of income consists of their own levied taxes (in 2021: € 3,138 million).23x CBS, ‘Opbrengsten waterschapsheffingen; begrotingen en realisatie’, www.cbs.nl/nl-nl/cijfers/detail/83520NED (last visited 31 October 2022).3.2 Legal Restrictions and Possibilities of Local Taxes in the Netherlands in General

In general, the legal framework of local taxation in the Netherlands is formed by four main pillars:

a closed system of taxes;

the obligation of compliance with higher rules;

the prohibition of taxing according to the ability to pay of the taxpayer; and

the autonomy to set tax bases and tariffs.

The first three pillars contain mostly restrictions for the taxing powers of a local government, whilst the fourth pillar states the (granted) tax autonomy of local governments.

3.2.1 Pillar 1: Closed System of Taxes

Firstly, local authorities in the Netherlands can only levy taxes if and to the extent that the national legislator (defined in the Constitution as the Cabinet and Parliament acting in concert) has given them the power to do so.24x Art. 132 Constitution of the Netherlands in conjunction with Art. 219 Municipalities Act. In the Dutch context, this is called a ‘closed system’.25x As opposed to an open system which for example exists in Belgium where local governments can – within certain restrictions – create their own taxes and levies. See M.J.M. de Jonckheere, A.W. Schep, & A.P. Monsma, pages 468 and 470 ‘Open versus Closed Competence to Tax: A Comparative Legal Study of Municipal Taxes in Belgium and the Netherlands’, 47(5) Intertax 468 (2019). This means that the ‘menu’ of taxes which local authorities can introduce has been stipulated in an Act of Parliament and that they are bound by the restrictions set therein (principle of legality). Twelve Dutch municipal levies are based on the Municipalities Act.26x These are taxes on immovable property (Arts. 220-220h); taxes on movable property (Art. 221); taxes on commuting (Art. 223); a tax levied from tourists (Art. 224); parking taxes (Art. 225); dog license taxes (Art. 226); advertising taxes (Art. 227); sufferance taxes (Art. 228); sewing charges (Art. 228a) and fees on utility, pleasure and amusement rights (Art. 229). Two more municipal taxes have been made possible by separate laws.27x These are the waste tax in respect of the disposal of household waste, which is levied based on the Environmental Protection Act, Art. 15.33, and the BIZ-Contribution in BI-Zones (Business Investment Zones), based on the BI-Zones Act. The taxes levied by water boards are based on the Water Boards Act and the provincial taxes are based on several laws.

If local governments in the Netherlands want to use their tax sovereignty to contribute to a more sustainable society, they must meet the rules and obligations of the Dutch local tax system. The closed system and the principle of legality involves a limitation in the taxable events that can be chosen by the local government. The same applies to the wording of the essential elements of a levy in a local regulation: the municipality council has to stay within the boundaries set by the national legislator.

In the Netherlands, local levies can be categorised into three types, each with its own characteristics, restrictions and possibilities:General taxes. Can be characterised as forced payments to the municipality, whilst the municipality does not offer any direct, individual performance in return. Revenues go to the general funds of the municipality and can be spent by the municipality as it sees fit.28x Dutch municipalities can levy the following general taxes: property taxes (onroerende-zaakbelastingen), taxes on movable residential and business premises (roerende woon- en bedrijfsruimtebelastingen), commuter taxes (forensenbelastingen), tourist tax (toeristenbelasting), parking taxes (parkeerbelastingen), dog tax (hondenbelasting), advertising tax (reclamebelasting) and sufferance tax (precariobelasting).

Fees (duties). Can be distinguished from general taxes because they are levied regarding a specific, individual service rendered by the government, acting in its governmental capacity. There are no fees due when the government has not rendered any services. Furthermore, it is required by law that the tariffs are established in such a way that the projected benefits do not exceed the projected costs.29x Art. 229b Municipalities Act. Fees come in all sorts of levies, based on enjoying municipal services or the use of municipal property.30x The following fees are i.a. levied in the Netherlands: cleaning fees, funeral services fees, burial fees, fire department fees, fees for permits and official documents, harbour fees and market fees.

Destination-based taxes. Can be distinguished from a general tax because destination-based taxes entail a form of cost recovery. The tax revenue is intended for a specific purpose. The costs of certain municipal facilities are allocated towards a group of benefiting taxable subjects or objects. Unlike fees, the service provided by the government of which the costs are recovered by the destination-based taxes does not have to render any individual profit.31x In this way, destination-based taxes are an instrument of allocation: the tax burden is distributed among those who benefit of the corresponding municipal service (‘profit principle’) or who cause municipal costs (‘the polluter pays-principle’). Another characteristic is the relation between costs and the tax, which limits the rates: the tax income may not exceed the related costs.,32x Dutch destination-based taxes are the betterment levy (baatbelasting), the sewerage tax (rioolheffing) and the household waste tax (afvalstoffenheffing).

3.2.2 Pillar 2: Compliance with Higher Rules

Secondly, municipalities must stay within the boundaries of higher legislation and – written and unwritten – principles of proper legislation and good administration. Examples of higher legislation are Acts of Parliament (like the restrictions for the different taxes given in the Municipalities Act), the Constitution and Treaties. An example of a general principle is the principle of equality.

The obligation to comply with higher rules can restrict the leeway for local governments to implement more climate-friendly policies. For instance, varying rates to stimulate more climate-friendly behaviour must meet general legal principles, such as the principles of equality and proportionality. National legislation does, for example, not explicitly prohibit implementing a lower tariff for the sewerage levy for residential homes with a climate-friendly (sedum) roof and excluding other buildings from this tax incentive. Nevertheless, this is not allowed without an objective and reasonable justification for this selective preferential treatment. This justification can be tested by the judiciary.33x For example: Court of Appeal Arnhem-Leeuwarden 14 December 2021, ECLI:NL:GHARL:2021:11527.3.2.3 Pillar 3: Prohibition of Taxing According to Carrying Capacity of Taxpayers

Thirdly, the taxable amount may not be made directly dependent on personal income, business profit or capital/wealth.34x Art. 219(2) Municipalities Act and Art. 221(2) Provinces Act. The reason for this legal restriction is that income policy in the Netherlands is reserved for the central government only. It is considered undesirable that local taxes could distort central income policies.

In general, less wealthy taxpayers are sometimes less able to adjust their ‘polluting behaviour’ because more climate-friendly alternatives are too costly for them. For example, partly because of rising energy prices, there is a societal debate regarding the risk of ‘energy poverty’ among certain population groups.35x In 2021, for example, the central government made 150 million euros available to municipalities to take measures in residential areas with less wealthy residents aimed at saving energy, www.rijksoverheid.nl/actueel/nieuws/2021/10/15/150-miljoen-euro-voor-aanpak-energiearmoede-kwetsbare-huishoudens (last visited 31 October 2022).3.2.4 Pillar 4: Autonomy to Set Tax Bases and Tariffs

Despite the above-mentioned three main restrictions, Dutch local authorities have considerable freedom in drawing up their local tax regulations.36x For a more detailed analysis, see de Jonckheere, Schep & Monsma, above n. 26. Pages 469-473. Municipalities and provinces are explicitly allowed to set the taxable amount and tariff, if not yet laid down in a specific legal provision regarding the concerned tax. The same applies to the indication of the taxable person, the taxable object and exemptions. In that way, municipalities are capable of certain taxation policies. Furthermore, using a municipality’s tax or fee as a policy instrument is allowed. In fact, in the latest grand revision of the substantive local tax law provisions in the Dutch Municipalities Act, the national legislator explicitly stated that a more instrumental approach of local taxes not only is permitted, but even be stimulated.37x Documents of the House of Representatives 1989/1990, 21 591, no. 3, at 32-33, 65-67 and 77-78. See https://zoek.officielebekendmakingen.nl/0000041200 (last visited 31 October 2022).

The fourth pillar gives local governments the power to vary the amount of tax to fit their climate policies. Within the boundaries set by the national legislator concerning the possible levies and the essential elements of the tax (such as the taxable object), local governments have a certain autonomy. Nevertheless, local authorities must also consider higher laws, regulations and legal principles when exercising this policy freedom. For example, for the municipal advertisement tax the national legislator already codified the taxable object, namely ‘public announcements, visible from the public road’.38x Art. 227 Municipalities Act. Within the boundaries of this definition, the municipality may choose to vary the rate for various kinds of advertisements. The council could for example set a higher rate for neon signs, which could be justified by the higher carbon emission.3.3 Restrictions and Possibilities in Funding Climate Goals with Municipal Taxes

In this section, we describe some examples of possibilities of funding climate goals with different municipal taxes. Based on the type of levy (as described in Section 3.2.1), the possibilities of using tax revenue for funding of climate policies can vary. In theory, the possibilities of general taxes are wider than with fees or destination-based taxes since the rates of general taxes are not legally restricted or bound by the costs of rendered services. To fund climate initiatives, the (potential) revenue has to be substantial. The question is whether local tax revenue in the Netherlands meets this requirement. As described in Section 3.1, the revenues of all types of local governments combined represent a share of only 3.4% of the total revenue of all levels of Dutch government.

3.3.1 Property Tax

Dutch municipalities have limited possibilities of using property tax to fund climate mitigation measures. This is due to the extensive regulation of this tax.39x Art. 220 Municipalities Act. The property tax is limited to three categories of tax subjects: 1) owners of non-residential properties, 2) users of non-residential properties and 3) owners of residential properties. Other forms of tariff differentiation are not allowed. For example, the tariffs cannot be made dependent on an energy label that is linked to the property. The amount of tax is mandatorily related to the value of the property. However, municipalities can decide how the revenue of the property tax will be spent. For example, municipalities can decide to increase one or more rates of the property tax to invest the additional revenue in a climate fund. In various Dutch municipalities, there are already so-called ‘revolving funds’ that are financed in this way with an increase in property tax rates.40x For example Leiden: www.ondernemersfonds.nl (last visited 31 October 2022), and Utrecht: www.ondernemersfondsutrecht.nl (last visited 31 October 2022). The property tax, which in itself qualifies as a general tax, thus partly acquires the character of a destination-based tax.

Within this framework, the effects of making real property more sustainable for the valuation must be mentioned. International research shows that investing in making real estate more sustainable leads to higher values and thus to higher property tax revenue.41x P. Zancanella, P. Bertoldi, & B. Boza-Kiss, Chapter 2, page 14. ‘Energy Efficiency, the Value of Buildings and the Payment Default Risk’, JRC Science for Policy Report 2018. In principle, this effect of an increase in value leads to higher taxation of property tax. This effect is undesirable, given the fact that many municipalities, such as the city of Rotterdam, have established their own local climate policy, which is aimed at making real estate more sustainable. We therefore find that the system of the most important own municipal tax undermines local climate policy. The municipal taxation of properties forms in that sense a financial impediment to investing in making real property more sustainable. Previous research conducted by us into the possibilities of local taxation to facilitate efforts in making port-related industry more sustainable confirms this observation.42x A.P. Monsma, A.W. Schep, J.A. Monsma, & R.H. Kastelein, ‘Gemeentelijke belastingheffing & verduurzaming van havengebonden en industrieel vastgoed’, ESBL Report 2020, www.eur.nl/sites/corporate/files/2021-03/esbl-rapport-verduurzaming-havengebonden-vastgoed-juli-2020-finaal.pdf (last visited 31 October 2022).3.3.2 Baatbelasting (Betterment Levy)

To lower carbon emissions, the Dutch government has concluded that the natural gas connection in residential homes should be replaced by an alternative (low emission) heating solution. Homeowners are responsible themselves for the replacement and for the insulation, which is often needed for the usability of the alternative heating facility. It is not yet forbidden to use natural gas, but as part of the municipality’s Regional Energy Strategy (as mentioned in Section 1), the municipality can set a deadline in future for disconnection of the gas supply. Municipalities in the Netherlands have been identified as the competent authority to create the conditions for citizens to replace their natural gas connection. Besides the availability of an alternative solution, a major condition is affordability. The estimated replacement costs, including the necessary insulation, for a residential home are high: € 40,000 on average.43x J. Arnoldussen e.a., Proeftuinen aardgasvrije wijken. Een maatschappelijk-economische analyse van de proeftuinen (2021), www.eib.nl/publicaties/proeftuinen-aardgasvrije-wijken/.

One option for the municipality to create the conditions for the transition is to provide for a public heating solution for the whole district. An example is an environment-friendly underground heat network that uses the residual heat of industrial plants nearby. The construction costs of this public heating network can be recovered by a municipal tax: the ‘baatbelasting’ (betterment levy).44x A.P. Monsma, ‘Warmtenet Groningen: baatbelasting en ozb’, ESBL Report 2020, www.eur.nl/sites/corporate/files/2020-12/eindrapport_baatbelasting_ozb_warmtenet_groningen.pdf; A.P. Monsma and M.R. de Boer, ‘Fiscale bekostiging warmtenet Drechtsteden’, ESBL Report 2019, www.eur.nl/en/esl/media/83899#:~:text=De%20aanleg%20van%20een%20warmtenet,gebaat%20zijn%20door%20de%20aanleg (last visited 31 October 2022). The levy is imposed on the owners of all immovable property in the vicinity, on the condition that the property can be connected to the network. To keep this solution affordable, the levy can be spread over 30 years. Using this tax, the (extra) tax burden can be put specifically on the benefiting group and not, as is the case with the property tax, on all taxpayers.

Another option that is currently being investigated is funding adjustments in private property. Homeowners are responsible for the adjustment of their property, which is necessary to (technically) connect to an alternative heating solution. The costs of these adjustments, like insulation and solar panels, could form an obstacle to the owner to make the adjustments. Financial instruments for private persons, such as mortgages and borrowings, could help. But for a part of the homeowners, those financial instruments are not an ideal solution, due to borrowing restrictions and interest rates. In a recent report, we investigated on behalf of the Utrecht Province whether the betterment levy can be used in this case.45x A.W. Schep, A.P. Monsma, R.H. Kastelein, & B.S. Kats, ‘De gemeentelijke verduurzamingsregeling getoetst’, ESBL/EY Report 2022, www.eur.nl/en/esl/media/2022-02-de-gemeentelijke-verduurzamingsregeling-getoetst-def (last visited 31 October 2022). The Dutch municipality Wijk bij Duurstede already experimented with this type of taxation. Advantage of the betterment levy over a mortgage or borrowing is the long payback period of 30 years, the low interest and the connection between the monthly tax amount and the monthly reduction in energy costs because of the home adjustments. Also, the betterment levy is linked to the immovable property instead of the property owner, which ensures an automatic shift of the residual tax amount to a next homeowner in case of removal within the 30-year period. All in all, the betterment levy is a promising option in this respect but meets legal restrictions which could only be resolved by the national legislator. The provision in the law should make it possible for the municipality to use the levy as a specific cost recovery instrument for adjustments to individual residential homes instead of a levy based on cost recovery of public amenities within a certain district. After consideration of this option by the national legislator, in November 2022 the decision was made not to choose this path, but to develop other legislation for building-related financial instruments to make residential homes more sustainable.46x See parliamentary documents: Kamerstukken II 2021-2022, 30196, nr. 788, Kamerstukken II 2021-2022, 32847, 885 and Kamerstukken II 2022-203, 32847, nr. 980.3.3.3 Parking Taxes

It is conceivable that municipalities could use the parking tax to pay for climate initiatives. Local authorities could decide to invest the revenue of the parking tax (after increasing the rates) in environment-friendly alternatives to driving. For instance, one can think of investing in a mobility fund or a bicycle programme for the city.

3.3.4 Sewerage Levy

Municipalities are responsible for the ground water level. Due to climate change, periods of exceptional levels of rainfall are to be expected. To collect a huge amount of water in a brief time, big water collection reservoirs can be built underneath public squares, playgrounds and parks. The construction costs of these facilities can be recovered by the municipal sewerage levy. This levy can also be used to subsidise various private or business investments to prevent the amount of rainwater reaching the sewerage such as barrels to collect rainwater for households or the installation of a so-called green roof or living roof.

3.4 Restrictions and Possibilities of Influencing Behaviour with Municipal Taxes for Climate Goals

In this section, we describe some examples of the possibilities of using municipal taxes for stimulating more climate-friendly behaviour.

3.4.1 Waste Collection Levy

The municipal waste collection levy is an example of a highly effective tax for both cost recovery of municipal costs of collection and handling of household waste as well as an instrument for influencing behaviour of taxpayers. A municipality is allowed to introduce a ‘reversed’ collection policy: the collection of recyclable waste (such as glass, cardboard and vegetable, fruit and garden waste) is free of charge, whilst the collection of residual waste is paid for (by taxing the waste collection). This system has been proved to be effective in reducing waste.47x M.A. Allers and C. Hoeben, Chapter 2, pages 409-411, ‘Effects of Unit-Based Garbage Pricing: A Differences-in-Differences Approach’, 45(3) Environmental Resource Economics 405 (2010). In addition to a rate depending on the amount of residual waste offered, a fixed amount per collection location is often also used in most municipalities. In this way, the cost-effectiveness of the levy can be combined with the reduction of residual waste.

3.4.2 Property Tax

It is possible for municipalities to include exemptions in the property tax regulation. These exemptions may include certain sustainable investments. In our before mentioned research in the context of making port-related and industrial real estate more climate-friendly, we suggested altering the legislation to make an exemption for wastewater treatment plants.48x The current legal exemption is limited to government-managed wastewater treatment plants. We consider such an exemption to be a meaningful and justifiable option.49x Monsma et al., page 5, above n. 43.

Apart from making port-related and industrial real estate more climate-friendly, it is also conceivable, for example, to disregard the value of solar panels when determining the tax base for the property tax.50x See A.P. Monsma, ‘De modelakte zonnepanelen en de Wet WOZ’, 2019(43) Vastgoed Fiscaal & Civiel 1 (2019). For homes, the legal possibilities for this are currently being explored by the Dutch government.51x See the letter of the Minister of Internal Affairs of 14 January 2021, Documents of the House of Representatives, 2020/2021, 32 813, no. 658, https://zoek.officielebekendmakingen.nl/kst-32813-658.html (last visited 31 October 2022).3.4.3 Parking Taxes

In the Netherlands, municipalities can levy parking taxes for parking regulation purposes. That parking taxes are intended as an instrument for municipalities to regulate parking follows from the literal text of the law.52x Art. 225(1) Municipalities Act. In view of that regulatory objective, municipalities can choose to levy the parking tax only in a certain part of the municipality, or to differentiate rates per area. Where and under what conditions the tax is levied must be indicated in the municipal regulation. Several municipalities are currently responding to the climate change challenge by means of the parking tax. For example, by introducing an exempt for the parking of shared cars at designated places in the city, thus stimulating sustainable mobility.53x See www.share-now.com/nl/nl/ (last visited 31 October 2022).

Other examples of environment-friendly parking taxes can be found in municipalities where no parking tax is due on parking spaces for charging an electric car, for example, in Haarlem.

The parking tax rates can be set depending on parking duration, parking time, occupied surface and location of terrains or road sections.54x Art. 225(8) Municipalities Act. Other forms of rate differentiation than those mentioned in the law are not possible. Dutch municipalities can therefore not differentiate according to the degree of emission of a vehicle, also called ‘green rate differentiation’. We know that green rate differentiation is being applied in other countries, such as Norway and the United Kingdom.55x See R.H. Kastelein, page 7, ‘Groene parkeerbelastingen in binnen- en buitenland’, 5(17) MBB 32 (2022).

Parking taxes in the Netherlands were not originally created to respond to the climate challenges of municipalities. However, setting a price to parking with parking taxes can become an incentive for alternative less polluting forms of transport such as public transport. From this point of view, parking taxes are environment-friendly taxes, although this was not the reason to introduce them.3.4.4 Sewerage Levy

Dutch municipalities can introduce two types of sewerage levy side by side: a sewerage levy for the disposal of wastewater and a sewerage levy for the drainage of rainwater. Regarding climate adaptation in the form of making cities rainproof, another possibility is stimulating households to uncouple rainwater drainpipes from the sewer and to green their garden by varying the tariff of the sewerage levy for rainwater. A tariff of sewerage levy dependent on the percentage of the garden surface that is tiled is another possibility.

3.5 Promoting Climate Goals by Taxes of Provinces and Water Boards

3.5.1 Provinces

Provinces in the Netherlands have traditionally played a coordinating role when it comes to the spatial layout of the country. They could for example decide where industrial plants, agriculture and living areas are allowed. Together with municipalities, they are also responsible for making the regional energy plans, to switch off gas in living areas. Like municipalities, provinces receive most of their funding from the central government, as described in Section 3.1. By far the most important provincial ‘own’ source of tax revenue comes from surcharges on the motor vehicle tax, levied by the central government. In the National Climate Agreement, it was decided to introduce a 0-rate in the motor vehicle tax for electric vehicles.56x See National Climate Agreement, above n. 2, at 64-68. As a result of this central government decision, provinces miss tax revenue. In time, the motor vehicle tax will be replaced by a kilometre-based charge. A revision of the provincial tax area is therefore under consideration.57x See Ministry of Home Affairs and Kingdom Relations, ‘Herziening provinciaal belastinggebied’, www.rijksoverheid.nl/documenten/kamerstukken/2021/05/27/aanbieding-rapport-herziening-provinciaal-belastinggebied (last visited 31 October 2022). This could be an opportunity to introduce new taxes or rate differentiation options aimed at achieving climate objectives. Because of the dependence on the state regarding their own tax revenue, provinces lack experience and an executive office for the execution of taxation. Using their regulation powers in spatial planning and granting permits are likely to be more effective measures in achieving climate goals.

3.5.2 Water Boards

Water boards in the Netherlands have specific tasks related to water management. Part of that task is building and keeping dikes to protect the areas below sea level in the Netherlands. Due to longer periods of drought, water boards have to inspect more often the quality and strength of the dikes. Also, water boards may have to do more in order to keep a proper water level in the water system. These adjustments might lead to higher costs. Since water boards pay their tasks completely by own levies (without grants from the central government) these levies will probably increase.

Water boards in the Netherlands are also responsible for turning wastewater into drinking water through purification. This purifying process can be made more circular by using green energy for the machinery. The wastewater treatment process itself yields energy, which can be converted into green energy, biogas to power cars or electricity to be supplied to households. The raw materials that can be recovered from wastewater include phosphate, which is used to produce fertilisers. Finally, the residual silt can be recovered and turned into bioenergy. Water boards are currently setting up an ‘Energy and Resources Factory’ to enhance these circular initiatives.58x See www.efgf.nl/english (last visited 31 October 2022). We have researched the legal possibilities and restrictions of funding these initiatives within the rules set by the national legislator for the water treatment levy.59x J.A. Monsma and A.P. Monsma, ‘Rapportage onderzoek fiscaal-juridische advisering over energieproductie door waterschappen’, ESBL Report 2019; Documents of the House of Representatives 2018/2019, 35 000-J, no. 30, annex, https://zoek.officielebekendmakingen.nl/kst-35000-J-30.html (last visited 31 October 2022). The main conclusion is that as long as these initiatives remain a side effect or by-product of the execution of their public task, they are allowed according to the Water Boards Act and its legal history, and the costs and benefits can be incorporated in the corresponding levies.

In 2022, a draft law was made to confirm this option by an explicit legal article in the Water Boards Act.60x See www.internetconsultatie.nl/wijziging_waterschapsbelasting (last visited 31 October 2022). In the draft there is also a proposal to enable water boards to use substances for measuring the pollution load of discharged water that are less harmful to the environment than the substances that are now prescribed by law. It also proposes the possibility of paying industrial companies for supplying their wastewater, in case this water contains valuable substances or makes the purifying process more effective. By doing so, water boards hope to keep receiving this wastewater. Industrial companies are not obliged to discharge their wastewater into the purifying system of the water board; they are also allowed to purify the water themselves. Two more proposals were made concerning climate adaptation. The first proposed amendment enables the water boards to impose an extra rate on a specific group that requests or uses an extra clean water supply in case of drought. Secondly, the draft law ensures the option for water boards to take measures to prevent rainwater drainage into the purifying system of the water boards. -

4 Analysis: Relevant Insights Outside the Dutch Context

In addition to the insights on the role that taxes in general can play in achieving climate goals, as described in Section 2, in this section we specifically analyse the roles that taxes from local governments could play. We will focus on insights that can also have relevance outside the Dutch context.

First, we note that the global climate objectives are not only reflected in national legislation, but also in new tasks and responsibilities for local authorities. In addition, we note that large cities in particular have also formulated their own climate plans that sometimes go beyond the national climate objectives. We also note that the new tasks assigned to Dutch local authorities in the context of the climate goals have not yet led to legal adjustments to the local tax systems.

If we look at the current possibilities and limitations that apply specifically to the Netherlands, the following conclusions can be drawn from this, which may also have relevance for systems other than the Dutch local tax system. First, the observation that the revenue from local taxes is relatively insignificant compared to other OECD countries. If a larger part of the total funding of local governments would come from local taxes, there could be wider opportunities to stimulate or finance climate goals fiscally. In addition to financial space, local governments are also dependent on the central government for the extent to which they are empowered to make autonomous choices. In the Netherlands, local governments are prohibited to levy according to the ability to pay of taxpayers (see Section 3.2.3). In countries where this restriction does not apply, there may be broader possibilities in directing behaviour. Then, the ability of taxpayers to pay when taxing climate-unfriendly behaviour can also be considered in the taxation. In the Dutch context, taxing undesirable behaviour at local level means that the well-to-do can adjust their behaviour by, for example, purchasing an electric car, so that the tax burden mainly falls on the less well-off.

Furthermore, the Dutch system is determined by the fact that it is a closed system (see Section 3.2.1). Local authorities in the Netherlands are not authorised to design and introduce their own taxes, unlike the open system of local taxes in Belgium, for example.61x See de Jonckheere, Schep, & Monsma, above n. 26. New specific local environmental taxes are only possible in the Netherlands after the central government makes this legally possible. This also has implications for the pace at which local governments can adjust their tax policies. In the Dutch context, it is therefore essential that municipalities and provinces are allowed to set the taxable amount and tariff, the taxable person, the taxable object and exemptions. This competence extends to limited, but concrete possibilities for the use of local taxes for climate goals, as described in Sections 3.3, 3.4 and 3.5.

Then there is the distinction between funding measures on the one hand (Section 3.3) and steering behaviour on the other (Section 3.4). In the Dutch context, we note that general taxes in particular can be used both to finance climate measures and to steer behaviour. Examples are the general taxes whose revenues are used for certain investments that lead to more climate-friendly behaviour. An example is using the parking tax revenue to fund climate initiatives, such as environment-friendly alternatives to driving a car with an internal combustion engine. Another example is to use the revenue of the tourist tax to stimulate sustainable tourism by subsidising sustainable initiatives of the tourism industry. Another example is the ‘revolving funds’ mentioned in Section 3.3.1, funded with the revenue of the property tax. From these funds, various environment-friendly initiatives could be subsidised or funded.

The observed effects of making immovable property more sustainable on its value also have consequences for property taxes in countries other than the Netherlands. This is a general consequence of sustainability, according to international research, mentioned in Section 3.3.1. The local taxation of real properties forms in that sense, a financial impediment to investing in making real property more sustainable. We can imagine that in various countries specific exemptions from property tax will arise for investments in making real estate more sustainable.

International research into parking taxes shows that green parking taxes can have a positive impact on the climate.62x R. Wolbertus, M. Kroesen, R. van den Hoed, & C.G. Chorus, ‘Policy Effects on Charging Behaviour of Electric Vehicle Owners and On Purchase Intentions of Prospective Owners: Natural and Stated Choice Experiments’, 62 Transportation Research Part D (Elsevier Ltd.) 283, at 293-294 (2018). However, the greatest climate impact is achieved within a broader package of measures.63x K.Y. Bjerkan, T.E. Nørbech, & M.E. Nordtømme, ‘Incentives for Promoting Battery Electric Vehicle (BEV) Adoption in Norway’, 43 Transportation Research Part D (Elsevier Ltd.) 169, at 176 (2016). As an example of this type of measure, environmental zones can be mentioned. There are also points of attention. For example, foreign parkers can be disadvantaged compared to domestic parkers. This is because foreign vehicles are not registered in the national vehicle registration, so these vehicles – which are often driven by foreigners – do not receive a green discount or exemption. Potentially, this is contrary to European law.64x Art. 18 Treaty on the Functioning of the European Union.

The examples we have described of the use of water boards’ taxes for climate goals illustrate, on the one hand, the need of local governments to actively contribute to climate objectives and, on the other hand, that the active participation of the legislator can lead to successful adjustments to the tax system. -

5 Conclusion

In this article, we first investigated the roles (local) taxes in general can play in pursuing climate goals. The role of taxation in helping achieving sustainability goals by its revenue has been broadly acknowledged and recommended by several international organisations.

At the same time, in the literature there is not a widespread consensus about using taxes for social engineering. This role meets several ‘ifs, buts and maybes’. A major concern is the effectiveness of fiscal (dis)incentives in achieving the aspired goal. Given these concerns, tax influencing can only play a modest role helping achieve climate goals. For local taxes, all the above-mentioned concerns are applicable. The major concern, namely the effectiveness of tax measures, is even more important for local taxation. In the Netherlands, rates and therefore the potential revenue of local taxes is relatively low which could also hinder the effectiveness of tax measures for climate policies. The effectiveness of tax measures at the level of the local government can also be negatively affected if different neighbouring local governments implement different tax incentives and disincentives. People might avoid higher rates by moving polluting behaviour to the neighbouring municipality. Given these concerns, we described several restrictions, possibilities and examples for both funding climate goals and influencing behaviour with local taxes in the Dutch context. This led to an analysis of relevant insights outside the Dutch context. The examples we describe illustrate that local taxes do offer opportunities to contribute to the achievement of climate goals. - * ESBL is part of the Department Law & Tax of Erasmus School of Law of the Erasmus University Rotterdam. The Endowed Chair of Taxes of Local Government and ESBL are co-funded by the J.H. Christiaanse Foundation in which representatives of the Erasmus University as well as several local governments participate. See for more info: www.esbl.nl.

-

1 See for version of the Climate Agreement translated in English: www.klimaatakkoord.nl/documenten/publicaties/2019/06/28/national-climate-agreement-the-netherlands (last visited 31 October 2022).

-

2 Klimaatwet, Stb. 2019, 254, https://wetten.overheid.nl/BWBR0042394/2022-03-02 (last visited 31 October 2022). The goals are regulated in Art. 2 Climate Act of which the first clause states: ‘This law provides a framework for the development of policies aimed at irreversibly and step-by-step reduction of greenhouse gas emissions in the Netherlands, to a level that is 95% lower in 2050 than in 1990, in order to limit global warming and climate change’. Art. 2(2) states: ‘In order to achieve this target for 2050, our Ministers who are concerned aim for a reduction in greenhouse gas emissions of 49% by 2030 and a full CO2-neutral electricity production by 2050’.

-

3 See the advice from The Council for Public Administration, ‘Van Parijs naar praktijk; bekostiging en besturing van de decentrale uitvoering van het klimaatakkoord’, www.raadopenbaarbestuur.nl/documenten/publicaties/2021/01/25/advies-van-parijs-naar-praktijk (last visited 31 October 2022).

-

4 The role of local governments in the achievement of SDGs is also acknowledged by the EU Commission: see https://ec.europa.eu/commission/presscorner/detail/en/IP_22_5395 (last visited 31 October 2022).

-

5 See the website of the National Program Regional Energy Strategy: www.regionale-energiestrategie.nl/default.aspx (last visited 31 October 2022).

-

6 See for the endorsements of the Association of Dutch Municipalities: https://vng.nl/rubrieken/onderwerpen/klimaatakkoord; Waterboards: https://unievanwaterschappen.nl/themas/klimaatakkoord/; and Provinces: www.ipo.nl/thema-s/klimaat-en-energie/ (all last visited 2 December 2022).

-

7 See for examples the cities of Amsterdam: www.nieuwamsterdamsklimaat.nl/, Rotterdam: www.rotterdamsklimaatakkoord.nl/ and The Hague: www.haagsklimaatpact.nl/index.php/ambities-haags-klimaatpact/ (last visited 31 October 2022).

-

8 See the advice from The Council for Public Administration, above n. 4.

-

9 A. Pirlot, Chapter 4, pages 17-18 ‘A Legal Analysis of the Mutual Interactions between the UN Sustainable Development Goals (SDGs) and Taxation’, in C. Brokelind and S. van Thiel (eds.), Tax Sustainability in an EU and International Context (2020). She mentions UN General Assembly, Resolution A/RES/70/1, ‘Transforming Our World: The 2030 Agenda for Sustainable Development’, adopted on 25 September 2015, 21 October 2015, at paragraph 17.1, p. 26. And OECD, ‘OECD and the Sustainable Development Goals: Delivering on Universal Goals and Targets’, at www.oecd.org/dac/sustainable-development-goals.htm (last visited 31 October 2022). She also refers to IMF, OECD, UN, World Bank Group, ‘Taxation & SDGs. First Global Conference of the Platform for Collaboration on Tax’, Conference Report, 14-16 February 2018. See www.oecd.org/ctp/countries-must-strengthen-tax-systems-to-meet-sustainable-development-goals.htm (last visited 31 October 2022).

-

10 For a more elaborated view on the effectiveness of environmental taxes in achieving climate goals, see D. Fullerton, A. Leicester, & S. Smith, Chapter 5, pages 435-436 ‘Environmental Taxes’, in Dimensions of Tax Design (IFS 2010).

-

11 F. Vanistendael, Chapter 2, page 51 ‘Reflections on Taxation and the Choice between Development and Sustainability’, in C. Brokelind and S. van Thiel (eds.), in Tax Sustainability in an EU and International Context (2020) and A. Redonda, Chapter 9 pages 193-194 ‘Tax Expenditures and Inequality’, in C. Brokelind and S. van Thiel (eds.), Tax Sustainability in an EU and International Context (2020).

-

12 S. van Thiel, Chapter 1, page 25 ‘Sustainable Taxes for Sustainable Development’, in C. Brokelind and S. van Thiel (eds.), Tax Sustainability in an EU and International Context (2020). Van Thiel refers to OECD, Tax Incentives for Investment: A Global Perspective Experiences in MENA and Non-MENA Countries (2008).

-

13 See for a more elaborated guideline for an effective approach of tax incentives for sustainable investments, including preventing the ‘gift effect’, IMF, World Bank, OECD and UN, Options for Low Income Countries’ Effective and Efficient Use of Tax Incentives for Investment, report to the G-20 Development Working Group, 2015.

-

14 See J. Pedroso and J. Kyrönviita, Chapter 16, page 377 ‘A Pluralistic Approach to the Question How to Balance Different Objectives of Sustainable Development through Environmental Taxes within the Framework of EU State Aid Law’, in C. Brokelind and S. van Thiel (eds.), Tax Sustainability in an EU and International Context (2020). See also P. Pistone and M. Villar Ezcurra (eds.), Energy Taxation, Environmental Protection and State Aids (2016).

-

15 See M. Lewandowski, Chapter 15, pages 347-349‘Energy Poverty and Energy Taxation in the European Union: An Overview of Tax Measures’, in C. Brokelind and S. van Thiel (eds.), Tax Sustainability in an EU and International Context (2020).

-

16 Vanistendael, above n. 12 pages 52-53 2.

-

17 Redonda, above n. 12, page 210.

-

18 Dutch water boards are regional governmental bodies charged with managing water barriers, waterways, water levels, water quality and sewage treatment in their respective regions.

-

19 By governmental financial transfers through grants from the Province Fund and Municipality Fund.

-

20 Organization for Economic Cooperation and Development (OECD), Revenue Statistics (2021), Table 1.4.

-

21 CBS, ‘Gemeentebegrotingen; heffingen naar regio en grootteklasse’, www.cbs.nl/nl-nl/cijfers/detail/83614NED (last visited 31 October 2022).

-

22 Ministerie van Financiën, ‘Rijksbegroting’, www.rijksfinancien.nl/memorie-van-toelichting/2022/OWB/C/onderdeel/1066575 (last visited 31 October 2022).

-

23 CBS, ‘Opbrengsten waterschapsheffingen; begrotingen en realisatie’, www.cbs.nl/nl-nl/cijfers/detail/83520NED (last visited 31 October 2022).

-

24 Art. 132 Constitution of the Netherlands in conjunction with Art. 219 Municipalities Act.

-

25 As opposed to an open system which for example exists in Belgium where local governments can – within certain restrictions – create their own taxes and levies. See M.J.M. de Jonckheere, A.W. Schep, & A.P. Monsma, pages 468 and 470 ‘Open versus Closed Competence to Tax: A Comparative Legal Study of Municipal Taxes in Belgium and the Netherlands’, 47(5) Intertax 468 (2019).

-

26 These are taxes on immovable property (Arts. 220-220h); taxes on movable property (Art. 221); taxes on commuting (Art. 223); a tax levied from tourists (Art. 224); parking taxes (Art. 225); dog license taxes (Art. 226); advertising taxes (Art. 227); sufferance taxes (Art. 228); sewing charges (Art. 228a) and fees on utility, pleasure and amusement rights (Art. 229).

-

27 These are the waste tax in respect of the disposal of household waste, which is levied based on the Environmental Protection Act, Art. 15.33, and the BIZ-Contribution in BI-Zones (Business Investment Zones), based on the BI-Zones Act.

-

28 Dutch municipalities can levy the following general taxes: property taxes (onroerende-zaakbelastingen), taxes on movable residential and business premises (roerende woon- en bedrijfsruimtebelastingen), commuter taxes (forensenbelastingen), tourist tax (toeristenbelasting), parking taxes (parkeerbelastingen), dog tax (hondenbelasting), advertising tax (reclamebelasting) and sufferance tax (precariobelasting).

-

29 Art. 229b Municipalities Act.

-

30 The following fees are i.a. levied in the Netherlands: cleaning fees, funeral services fees, burial fees, fire department fees, fees for permits and official documents, harbour fees and market fees.

-

31 In this way, destination-based taxes are an instrument of allocation: the tax burden is distributed among those who benefit of the corresponding municipal service (‘profit principle’) or who cause municipal costs (‘the polluter pays-principle’). Another characteristic is the relation between costs and the tax, which limits the rates: the tax income may not exceed the related costs.

-

32 Dutch destination-based taxes are the betterment levy (baatbelasting), the sewerage tax (rioolheffing) and the household waste tax (afvalstoffenheffing).

-

33 For example: Court of Appeal Arnhem-Leeuwarden 14 December 2021, ECLI:NL:GHARL:2021:11527.

-

34 Art. 219(2) Municipalities Act and Art. 221(2) Provinces Act.

-

35 In 2021, for example, the central government made 150 million euros available to municipalities to take measures in residential areas with less wealthy residents aimed at saving energy, www.rijksoverheid.nl/actueel/nieuws/2021/10/15/150-miljoen-euro-voor-aanpak-energiearmoede-kwetsbare-huishoudens (last visited 31 October 2022).

-

36 For a more detailed analysis, see de Jonckheere, Schep & Monsma, above n. 26. Pages 469-473.

-

37 Documents of the House of Representatives 1989/1990, 21 591, no. 3, at 32-33, 65-67 and 77-78. See https://zoek.officielebekendmakingen.nl/0000041200 (last visited 31 October 2022).

-

38 Art. 227 Municipalities Act.

-

39 Art. 220 Municipalities Act.

-

40 For example Leiden: www.ondernemersfonds.nl (last visited 31 October 2022), and Utrecht: www.ondernemersfondsutrecht.nl (last visited 31 October 2022).

-

41 P. Zancanella, P. Bertoldi, & B. Boza-Kiss, Chapter 2, page 14. ‘Energy Efficiency, the Value of Buildings and the Payment Default Risk’, JRC Science for Policy Report 2018.

-

42 A.P. Monsma, A.W. Schep, J.A. Monsma, & R.H. Kastelein, ‘Gemeentelijke belastingheffing & verduurzaming van havengebonden en industrieel vastgoed’, ESBL Report 2020, www.eur.nl/sites/corporate/files/2021-03/esbl-rapport-verduurzaming-havengebonden-vastgoed-juli-2020-finaal.pdf (last visited 31 October 2022).

-

43 J. Arnoldussen e.a., Proeftuinen aardgasvrije wijken. Een maatschappelijk-economische analyse van de proeftuinen (2021), www.eib.nl/publicaties/proeftuinen-aardgasvrije-wijken/.

-

44 A.P. Monsma, ‘Warmtenet Groningen: baatbelasting en ozb’, ESBL Report 2020, www.eur.nl/sites/corporate/files/2020-12/eindrapport_baatbelasting_ozb_warmtenet_groningen.pdf; A.P. Monsma and M.R. de Boer, ‘Fiscale bekostiging warmtenet Drechtsteden’, ESBL Report 2019, www.eur.nl/en/esl/media/83899#:~:text=De%20aanleg%20van%20een%20warmtenet,gebaat%20zijn%20door%20de%20aanleg (last visited 31 October 2022).

-

45 A.W. Schep, A.P. Monsma, R.H. Kastelein, & B.S. Kats, ‘De gemeentelijke verduurzamingsregeling getoetst’, ESBL/EY Report 2022, www.eur.nl/en/esl/media/2022-02-de-gemeentelijke-verduurzamingsregeling-getoetst-def (last visited 31 October 2022). The Dutch municipality Wijk bij Duurstede already experimented with this type of taxation.

-

46 See parliamentary documents: Kamerstukken II 2021-2022, 30196, nr. 788, Kamerstukken II 2021-2022, 32847, 885 and Kamerstukken II 2022-203, 32847, nr. 980.

-

47 M.A. Allers and C. Hoeben, Chapter 2, pages 409-411, ‘Effects of Unit-Based Garbage Pricing: A Differences-in-Differences Approach’, 45(3) Environmental Resource Economics 405 (2010).

-

48 The current legal exemption is limited to government-managed wastewater treatment plants.

-

49 Monsma et al., page 5, above n. 43.

-

50 See A.P. Monsma, ‘De modelakte zonnepanelen en de Wet WOZ’, 2019(43) Vastgoed Fiscaal & Civiel 1 (2019).

-

51 See the letter of the Minister of Internal Affairs of 14 January 2021, Documents of the House of Representatives, 2020/2021, 32 813, no. 658, https://zoek.officielebekendmakingen.nl/kst-32813-658.html (last visited 31 October 2022).

-

52 Art. 225(1) Municipalities Act.

-

53 See www.share-now.com/nl/nl/ (last visited 31 October 2022).

-

54 Art. 225(8) Municipalities Act.

-

55 See R.H. Kastelein, page 7, ‘Groene parkeerbelastingen in binnen- en buitenland’, 5(17) MBB 32 (2022).

-

56 See National Climate Agreement, above n. 2, at 64-68.

-

57 See Ministry of Home Affairs and Kingdom Relations, ‘Herziening provinciaal belastinggebied’, www.rijksoverheid.nl/documenten/kamerstukken/2021/05/27/aanbieding-rapport-herziening-provinciaal-belastinggebied (last visited 31 October 2022).

-

58 See www.efgf.nl/english (last visited 31 October 2022).

-

59 J.A. Monsma and A.P. Monsma, ‘Rapportage onderzoek fiscaal-juridische advisering over energieproductie door waterschappen’, ESBL Report 2019; Documents of the House of Representatives 2018/2019, 35 000-J, no. 30, annex, https://zoek.officielebekendmakingen.nl/kst-35000-J-30.html (last visited 31 October 2022).

-

60 See www.internetconsultatie.nl/wijziging_waterschapsbelasting (last visited 31 October 2022).

-

61 See de Jonckheere, Schep, & Monsma, above n. 26.

-

62 R. Wolbertus, M. Kroesen, R. van den Hoed, & C.G. Chorus, ‘Policy Effects on Charging Behaviour of Electric Vehicle Owners and On Purchase Intentions of Prospective Owners: Natural and Stated Choice Experiments’, 62 Transportation Research Part D (Elsevier Ltd.) 283, at 293-294 (2018).

-

63 K.Y. Bjerkan, T.E. Nørbech, & M.E. Nordtømme, ‘Incentives for Promoting Battery Electric Vehicle (BEV) Adoption in Norway’, 43 Transportation Research Part D (Elsevier Ltd.) 169, at 176 (2016).

-

64 Art. 18 Treaty on the Functioning of the European Union.

Erasmus Law Review |

|

| Article | How Taxes of Local Governments Can Contribute to Climate Goals |

| Trefwoorden | local taxes, municipal taxes, property tax, climate goals, climate objectives |

| Auteurs | Arjen Schep, Anneke Monsma en Robert Kastelein * xESBL is part of the Department Law & Tax of Erasmus School of Law of the Erasmus University Rotterdam. The Endowed Chair of Taxes of Local Government and ESBL are co-funded by the J.H. Christiaanse Foundation in which representatives of the Erasmus University as well as several local governments participate. See for more info: www.esbl.nl. |

| DOI | 10.5553/ELR.000233 |

|

Toon PDF Toon volledige grootte Samenvatting Auteursinformatie Statistiek Citeerwijze |

| Dit artikel is keer geraadpleegd. |

| Dit artikel is 0 keer gedownload. |

Arjen Schep, Anneke Monsma en Robert Kastelein, "How Taxes of Local Governments Can Contribute to Climate Goals", Erasmus Law Review, 3, (2022):240-249

|

This article examines the roles (local) taxes can play in pursuing climate goals. The authors analyse the factors within the Dutch context which are limiting, and which are contributing to the effectiveness of the use of local taxes in the pursuit of climate goals. On the one hand, (local) taxes can serve their primary purpose: funding government spending, for example the creation of certain sustainable facilities. On the other hand, taxes can give a financial incentive to influence behaviour by improving the business case for sustainable solutions or make unsustainable behaviour more expensive or sustainable behaviour financially more attractive. This article presents examples of both funding sustainable facilities as of stimulating desired sustainable behaviour by means of a certain Dutch local tax measure. Despite the examples presented, we conclude that under the current legislative restrictions, in the Netherlands local taxes can play a modest role within the sustainability policy of local governments. The research into the current legal restrictions and possibilities for achieving climate goals with local taxes in the Netherlands leads to an analysis of insights that are also relevant outside the Dutch context. |